With the 2024 fall of the reigning king, the Greece Golden Visa, the new Hungary Golden Visa is set to become the EU’s #1 residency by investment option for entrepreneurs, investors, and families who seek a foothold in the European Union at the lowest threshold available.

Although the EU’s newest Golden Visa program has yet to launch, it is already garnering global attention. The Hungarian Guest Investor Program presents an incredibly appealing opportunity, and most experts believe it will replace the Greek Golden Visa as the EU’s go-to residency option.

Otherwise known as the Hungarian Golden Visa, the Guest Investor visa allows non-EU nationals to secure Hungarian residency, ETIAS exemption – and potentially EU citizenship – through real estate-oriented investments.

Not only will the Hungary Golden Visa have the lowest investment threshold in the EU [once the Greek Golden Visa price increases in August 2024], but the program will offer an unprecedented three distinct channels for real estate-based investing.

Hungary Golden Visa investment requirements

Hungary’s residence by investment program presents compelling options for investors seeking alternative residence or second citizenship opportunities.

The Hungary Golden Visa allows investors to obtain a renewable 10-year residence permit by making one of the following qualifying investments:

- Minimum of €250,000 in a registered Hungarian real estate fund or REIT

- Minimum of €500,000 in Hungarian residential real estate

- Minimum of €1 million donation to a public interest trust foundation supporting education, science, arts, or creativity

Those who maintain de facto residence in Hungary for five consecutive years after making a qualifying investment are then eligible to apply for permanent residency status.

Investors aiming to qualify for Hungarian (and thereby EU) citizenship essentially must move to Hungary. For citizenship eligibility, a provable physical presence as a tax resident (minimum physical presence of six months a year) in Hungary over an eight-year period is required.

Investing in Hungarian real estate or funds provides a pathway to residency and the potential for ROI and diversification benefits.

The real estate fund option allows investors to gain exposure to Hungary’s property markets through a managed investment vehicle.

Purchasing residential property gives investors direct and complete ownership of their real estate assets.

For ultra-wealthy investors prioritizing philanthropic pursuits, the donation route creates a path to residency by directly supporting communities in areas like education and the arts.

Substantial tax benefits can offset a portion of the €1 million cost, but this greatly depends on each investor’s existing tax obligations and nationality.

Fund composition and management

According to the Guest Investor Program requirements, at least 40% of a real estate fund’s net asset value must be invested in residential properties within Hungary.

This regulation ensures significant exposure to the country’s housing market while allowing for diversification into commercial real estate and other eligible assets.

Eligible investments for these funds include:

- Domestic and foreign real estate properties

- Shares in real estate companies

- Property-related rights and securities

- Money market instruments, currencies, and deposits

- Derivative instruments

- Movable assets necessary for property operations

Fund managers: The driving force

Real estate funds in Hungary are managed by licensed and experienced fund management companies. These managers play a pivotal role, overseeing all aspects of the investment process, from asset selection and acquisition to portfolio management and administration.

Fund managers must obtain a license from the NBH and maintain a minimum capital requirement, ensuring their financial stability and commitment to investor interests. They are responsible for developing and implementing the fund’s investment strategy, conducting due diligence on potential acquisitions, and maximizing returns for investors.

Investor protections and risk mitigation

The Hungarian regulatory framework provides several safeguards to protect investors in real estate funds. Funds are required to maintain a minimum level of liquidity (15% of assets in highly liquid instruments) and hold at least 5% of their holdings in Hungarian government bonds, ensuring financial stability and risk diversification.

Independent custodians are also appointed to safeguard the fund’s assets, manage bank accounts and securities accounts, and oversee the fund manager’s activities, providing an additional layer of oversight and transparency.

Valuation and risk management

Real estate funds in Hungary must employ licensed real estate appraisers to conduct regular valuations of their property holdings. These appraisals ensure that the net asset value per share accurately reflects the market value of the fund’s real estate portfolio, mitigating valuation risks.

Additionally, fund managers are required to develop and implement robust risk management policies that address liquidity risks, rental market volatility, and other potential threats to the fund’s performance.

Taxation and investor returns

Hungarian real estate funds are not subject to corporate taxation, as the fund itself is a pass-through entity. Investors are responsible for paying taxes on any income or gains derived from their investment, such as dividend distributions or capital gains from the sale of investment units.

The taxation of investor returns is governed by Hungarian tax laws and applicable double taxation treaties between Hungary and the investor’s country of residence. Generally, dividends and capital gains are subject to a 15% withholding tax in Hungary, but this rate may be reduced or eliminated under certain tax treaties.

For US investors, Hungarian funds may qualify as Passive Foreign Income Companies (PFICs) and will hence be taxed under the PFIC taxation regulations.

It is imperative for US investors to choose a PFIC-qualified fund that can produce the required documentation for tax purposes.

Hungary Golden Visa real estate investment options

The Hungarian real estate market continues to present compelling opportunities for investors seeking diversification, cash flow, and long-term appreciation.

Additionally, the timing of the Golden Visa program could not be better – genuinely presenting foreign investors access to a profitable market at one of the most opportune times in the past decade.

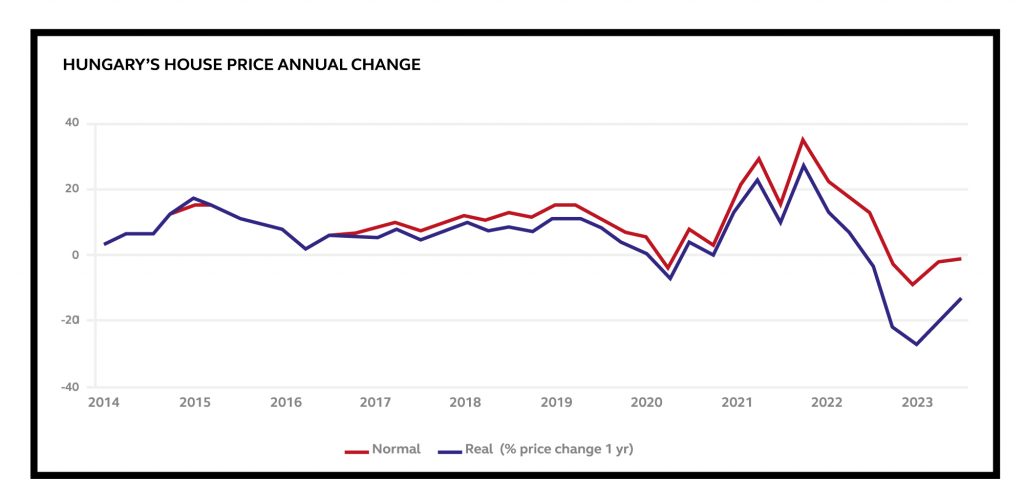

The Hungarian real estate market started 2023 off strong – coming off a record year in 2022 – but began to stagnate mid-year: a year-on-year decline in real estate prices has not been seen in almost a decade.

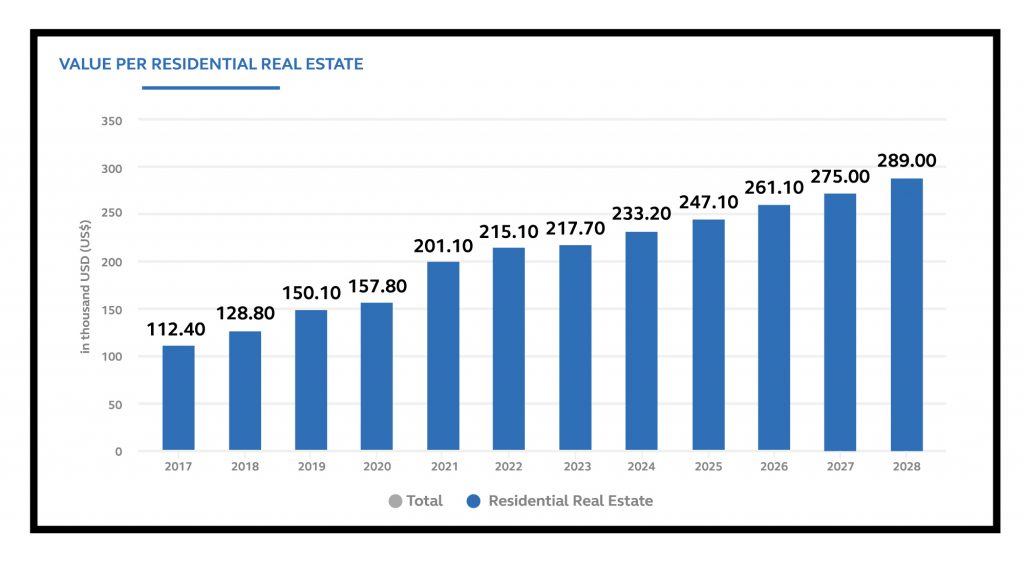

Nevertheless, the Hungarian rental market finished 2023 as a record year due to exorbitant demand, and the property market overall is, by expert accounts, expected to grow in 2024 [as illustrated in the Statista graph below].

In November 2023, Hungary’s Central Bank reported:

In 2023 Q3, banks experienced a rise in demand for housing loans, and looking ahead the vast majority of them expect this upturn to continue

From 2024 on, further progress in disinflation may return housing market activity to a gradual trajectory of growth

[In 2023] The average price of new homes in the capital was 8 per cent higher year on year, rising to HUF 1.46 million per square metre by the end of the third quarter, and even higher square-metre prices were observed in new construction projects around Lake Balaton.

In 2022, British investors began making their presence known in the Hungarian market, with a real estate FDI share exceeding 5% and growing – and as the Hungary Golden Visa is the perfect Brexit solution, that market share is expected to jump significantly in 2024.

Investors from the United States have yet to learn of the ground floor opportunity that is Hungary, but the Golden Visa program is specifically designed to change that, not only offering EU residency, but ETIAS exemption status, and a pathway to an EU passport.

For investors who prefer a more passive approach, real estate investment trusts (REITs) present the ability to invest in real estate without directly owning or managing properties.

Hungarian REITs own diversified portfolios of properties across residential, commercial, and specialty real estate sectors, and present a lucrative opportunity for foreign investors.

Under Hungarian law, REITs must distribute at least 90% of their distributable profit back to shareholders as dividends within 15 days of the fund’s annual report receiving official approval.

It should be noted, that REIT qualification under the program is still a bit unclear. The government is issuing more information regarding what, if any, REITs will be Golden Visa eligible, and Astons will keep our clients informed as updates are released.

When finalized, REITs would qualify under the fund investment category, not the real estate option, meaning investors who want to pursue REIT investments only need to invest €250,000.

Successful investing requires diligent market analysis, careful property selection, and a long-term investment horizon regardless of the real estate asset class.

However, the prospects remain very promising for those willing to develop their real estate acumen and execute prudent investment strategies.

As the Hungarian economy continues to grow [surpassing the EU average in 2023] and the property market is expanding, the fundamentals supporting continued real estate investment performance look robust.

Despite short-term cyclicality, real estate has historically proven itself to be one of the most lucrative and resilient investment vehicles—the very reason all monarchs maintain extensive real estate portfolios.

The Hungarian real estate market is a quintessential European example of real estate investing at its best.

Investor benefits and considerations

Investing in Hungarian real estate funds through the Guest Investor Program offers several advantages for non-EU nationals seeking residency and potential citizenship. These include:

- Professional management by experienced fund managers

- Diversification across multiple real estate assets

- Regulatory oversight and investor protections

- Potential for capital appreciation and rental income

- Streamlined investment process and reduced administrative burdens

However, before committing capital, investors must thoroughly evaluate the fund’s investment strategy, track record, and risk profile. Consulting with Astons is key to ensuring compliance with all relevant regulations and making informed investment decisions.

Hungarian residency and citizenship pathways

Upon making the required investment, non-EU nationals and their immediate family members become eligible for temporary residency in Hungary.

This residency permit is initially valid for ten years and can be renewed as long as the investment is maintained.

After ten years of legal residency, investors may be eligible to apply for Hungarian citizenship, subject to meeting additional requirements such as language proficiency, understanding of Hungarian culture and legal system, and a clean criminal record.

Benefits of Hungarian residency

Hungarian residency offers numerous advantages beyond just investment opportunities. Residents enjoy access to a high standard of living, excellent healthcare and education systems, and a rich cultural heritage.

Hungary’s strategic location in Central Europe provides easy access to other European countries, making it an ideal base for business and travel.

As a member of the Schengen Area, Hungarian residents can enjoy visa-free travel within most of Europe, enhancing mobility and convenience. Holders of the Hungary Golden Visa will also be exempt from ETIAS, the EU’s new eVisa launching in 2025.

Economic and cultural opportunities

Hungary boasts a vibrant and diverse economy, with strengths throughout various sectors such as manufacturing, technology, and services.

Investors can leverage these economic opportunities while immersing themselves in Hungary’s rich cultural tapestry, which includes historic cities, culinary delights, and vibrant festivals.

The country’s history and culture epitomize European opulence and a welcoming environment for international investors, further enhancing its appeal as a destination for those seeking a European base.

Golden Visa lifestyle and mobility

Beyond economic benefits, the Hungarian Golden Visa offers access to a high-quality European lifestyle that echoes the history of European opulence and molded European luxury living.

As Hungary is a member of the Schengen Zone, Hungarian citizens and residents enjoy visa-free travel within the zone and exemption from the ETIAS travel requirements.

This mobility is a significant advantage for business professionals and families, enabling seamless travel and integration into the European lifestyle.

And, if Hungarian citizenship is the ultimate goal, once achieved, it opens up the totality of the EU – enabling full residency, banking, and business rights in all EU countries, including:

- France

- Greece

- Germany

- Italy

- Spain

- Portugal

Administrative process and long-term commitment

To apply for the Hungarian Golden Visa, investors must submit a comprehensive set of documentation and undergo a thorough due diligence process to ensure compliance with international regulations. This is the key that distinguishes Astons as a global leader in our industry.

We assist investors throughout the totality of the process, ensuring a smooth and compliant investment experience.

Within the first 24 hours, Astons conducts an in-house due diligence screening to provide our clients with valuable insight about potential approval, empowering them to make the best and soundest investment decisions.

We stand behind the results of this preliminary review with our service fee.

Once approved, to maintain residency rights, investors must hold their investment to maintain Hungarian residency.

This long-term commitment ensures that the program supports serious investors interested in contributing to and benefiting from Hungary’s economic development.

Hungary – A European gem

The Hungarian Golden Visa program presents a unique opportunity for global investors seeking real personal and financial ROI and rights of access to the European Union.

By investing in regulated real estate funds, non-EU nationals can secure a foothold in Hungary, a vibrant nation with a rich cultural heritage and strategic location in Central Europe.

With a focus on sustainability, investor protection, and long-term commitment, the program offers a stable and secure path to European residency and potential citizenship.

Whether you’re an investor seeking diversification, an entrepreneur looking for a European base, a family seeking a high-quality lifestyle, or simply the highly-coveted EU Plan B to buffer against political uncertainty and concerns of social unrest at home, the Hungarian Golden Visa merits your full and serious attention.

As with any significant investment and relocation decision, it’s essential to consult with Aston’s qualified professionals and analyze your case to choose the best investment option.

With Aston’s guidance and preparation, the Hungarian Golden Visa could be your gateway to a world of opportunities in the heart of Europe.

Astons – Personalized partnership from beginning to end

While the investment requirements for Hungary’s residence by investment program are straightforward, navigating the process and establishing a personal infrastructure in the country can be complex for foreign investors.

This is where Astons provides exceptional value through comprehensive advisory services and dedicated personal assistance.

Astons offers end-to-end support tailored to each client’s unique needs throughout the entire investment journey.

Our team of experienced legal professionals, seasoned real estate experts, and relocation specialists ensure all Golden Visa application procedures are handled seamlessly and compliantly from start to finish.

But our partnership extends beyond submitting your Golden Visa application and the qualifying investment.

Astons can help create a complete personal infrastructure for the investor in Hungary.

The team at Astons recognizes that different investors have different priorities. Some seek a secondary European residence strictly for personal travel and lifestyle purposes, while others aim to establish a more comprehensive operational foothold for business and investment activities across Hungary and the broader EU.

Astons’ team takes a fully customized approach, serving as a single point of contact for all relocation and residency needs.

With decades of collective experience and a distinguished global presence, Astons helps affluent entrepreneurs, investors, and families enhance personal liberties, create mechanisms to safeguard generational wealth, and thrive with their new residences and citizenships.

Astons’ commitment is to exceptional client service and discretion – ensuring investor confidence and peace of mind throughout the entire process and beyond.

For more information regarding the Hungarian Guest Investor Visa or to take advantage of the Greek Golden Visa and the Caribbean Five citizenship programs before their prices double by mid-summer, schedule a Free Confidential and Comprehensive Consultation with Astons today.