Add it to the list, but the latest threat to HNW entrepreneurs and investors is not getting the media coverage it should be. It’s called de-banking, a new form of cancel culture, and it’s an increasing threat and trend throughout US banks.

According to the New York Times, banks are freezing and closing accounts of some of their clients with no prior warning and very little explanation – when any at all is provided.

The banking industry technically calls this ‘exiting’ or ‘de-risking,’ but in reality, it is simply ‘de-banking’ – America’s latest rendition of cancel culture, banking edition.

De-banking – Cancel culture evolves

In mid-2023, the media played heavily to the story of Nigel Farage, a former British politician and broadcaster, when the famed international bank, Coutts, suddenly closed his accounts.

Coutts de-banked Farage, who was further denied new accounts at nearly 10 other UK banks, based upon the bank’s assessment of Farage’s political and social beliefs and views as well as his professional network of colleagues – all of which the bank opposed.

As part of their decision-making process to de-bank Farage, Coutts’ reputational risk committee found that Farage was not “compatible with Coutts given his publicly-stated views that were at odds with our position as an inclusive organisation”.

Coutt’s official stance is that they de-banked Farage for failing to maintain the required £1 million balance. Farage acknowledges he did not satisfy the balance criteria but stated, “They [Coutts] didn’t have a problem with it for the last 10 years.”

Apparently, the bank balance issue suddenly clashed with Coutt’s values as an “inclusive organisation”; thus, they kicked him out, as inclusive organizations tend to do.

While the Farage incident in June 2023 garnered significant media coverage, primarily due to the high-profile nature of all the parties involved, it was incorrectly and inaccurately seen as the first such incident.

In reality, Coutts and the UK banking industry were doing what they always do: learning from their big brother across the Atlantic and following orders.

By the time the de-banking cancel culture hit Farage in the UK, it had already been actively occurring to US HNW entrepreneurs and investors for months. The New York Times pattern of reporting dates to at least April of 2023 and documents the US cancel culture of de-banking occurring in 2022.

The April 2023 New York Times article chronicles how Mr. Dhillon attended New York University and became a loyal client of Chase Bank in 2013 when he opened his first Chase account at their marketing booth at the university.

Fast-forward a decade of Chase loyalty and countless sums of legally hard-earned sweat and blood that he entrusted to Chase Bank, Mr. Dhillon was now sitting at a table in a French Bistro on Saks Fifth Avenue in New York City with friends when he went to pay the tab.

Embarrassingly, his credit card was first declined, and then his Chase debit card.

Later that evening, Mr. Dhillon called Chase only to be served with confirmation that Chase had closed his accounts. He was not given any reason why. After a decade of loyalty to Chase, Mr. Dhillon stated, “It was almost like getting a scarlet letter.”

Mr. Dhillon had been de-banked by Chase.

From that April 2023 story, the New York Times would pen at least five more articles over the following nine-plus months, all of which narrated a similar course of cancel culture of de-banking by top American banking institutions.

Justifying the cancel culture of de-banking

What the Farage case does perfectly demonstrate is how banks leverage their policies to create an exclusive “inclusive organisation”.

Officially, Coutts takes the stance that Farage failed to satisfy the bank’s balance requirements. Internally, Coutts admitted that Farage’s personal views were different from theirs.

Factually, either proposition essentially boils down to the fact that Farage was not Coutts’ kind of people any longer. This is a very ‘inclusive’ value proposition.

In the US, the banks are leveraging their partnership with the US government, specifically the FBI, to enforce the cancel culture of de-banking.

The banks are closing accounts [both personal and business accounts] based on transactions the banks flag and label as out of character for the account holder – often relying on algorithmically generated alerts reviewed by human employees.

A bank’s security measures sometimes prompt these closures, protocols supposedly designed to combat illegal activities.

These alerts are based on Suspicious Activity Reports (SARs). An automated flagging system that FinCEN [the Financial Crimes Enforcement Network – aka FBI] and banks claim can identify and flag illegal behavior, such as money laundering.

However, lately, the SAR system seems to have a loose grasp on reality.

The key, however, is not that SARs are being triggered, but the reality of how they are enforced – SARs rely heavily on humans [read bank and or government officials] to make the final decision regarding any supposed suspicious activity and to lock the account.

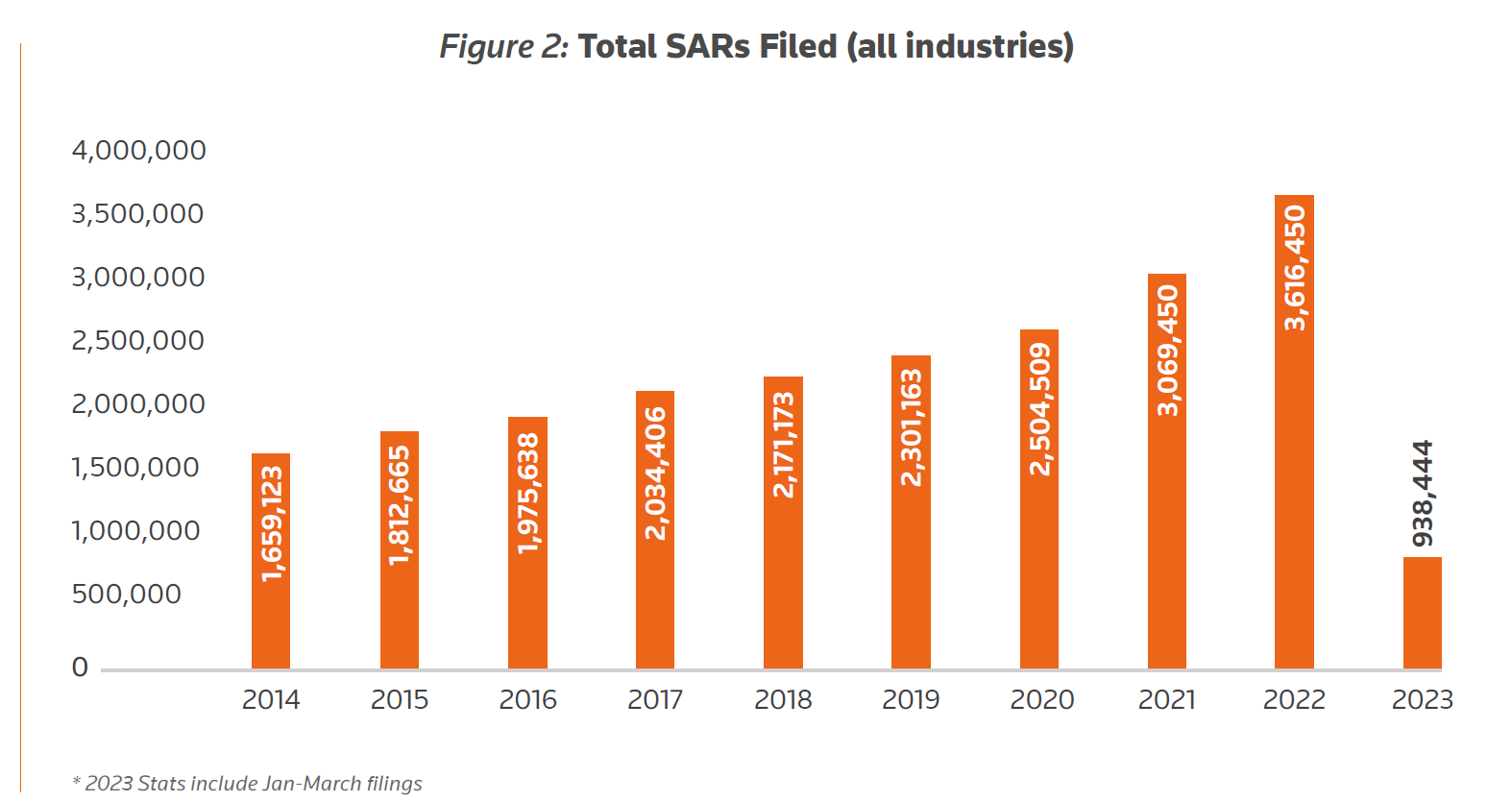

In the US, SARs are alarmingly on the rise – having increased significantly in the past few years.

At the time of the Farage-Coutts scandal, Thomas Reuters was already reporting on the surge of SARs in the US. The opening lines of their June 2023 article:

Financial institutions operating in the United States are filing soaring numbers of Suspicious Activity Reports (SARs), with the total number of SARs filed in 2022 surpassing 3.6 million filings, an increase of 57% from pre-pandemic 2019 levels.

More importantly, based on current predictions, SARs are on pace for another record year of filings in 2023.

Thomas Reuters created a chart and included it in their article, demonstrating the trending SAR activity:

As a point of reference, a Business Insider exposé on US cancel culture dates the contemporary origins of the US aberration to around 2017 – followed by the COVID situation of 2019-2020.

However, SARs are not always the cited issues, as reported in May 2023, Business Insider along with the Wall Street Journal also exposed the issue of de-banking, specifically as it was alleged by 19 states against JPMorgan, in which:

19 states have accused JPMorgan Chase of closing accounts and discriminating against customers due to their political or religious beliefs

That Business Insider report sources an official May 2023 letter from the Office of the Attorney General of Kentucky to JPMorgan, and documents JPMorgan’s de-banking practices dating back to at least 2021, and the Attorney General titles the letter:

Re: Discrimination by Chase Due to Religious or Political Affiliation

De-banking underscores a significant issue within the banking industry: efforts to comply with regulatory obligations and prevent illegal activities can go awry—either intentionally or otherwise.

Is that to suggest that all de-banking and every SAR is doing something other than what it is meant to do?

As SARs are directly connected to suspicious banking activity that falls into a specific genre of crime—such as money laundering or drug activity—there should be a corresponding rise in federal criminal charges and prosecutions related to SARs.

Spoiler alert – there isn’t.

Cancel culture or lack of communication

The human element goes to the heart of the de-banking issue, and, as many HNW entrepreneurs and investors are arguing, these banks are nothing more than emissarial arms of the government’s agenda to transform society into an “inclusive organisation”.

However, when genuine reasons are not provided to the victims of de-banking, what else can the victims do but conduct their own investigations to find the answers?

The lack of clear communication and recourse for victims of de-banking highlights the need for a more balanced approach that ensures security without compromising customer trust and financial stability. In other words, what banking is supposed to be.

The recent prevalence of de-banking highlights the increasing government involvement in the US financial and banking sector. This involvement is criminalizing the daily activities of HNW entrepreneurs and investors, disrupting both life and business.

The New York Times highlighted numerous examples of the cancel culture of de-banking involving America’s largest banks:

- JPMorgan Chase Bank – was by far one of the most common offenders

- Citi Bank

- Fifth Third

This trend genuinely illustrates the risk of one government monopolizing a person’s rights under one restrictive financial regulatory regime—or, better stated, of an entrepreneur or investor permitting themselves to be a victim of such a situation.

Investment migration and hedging against de-banking

The issue of de-banking highlights how fragile a person’s life is when an entrepreneur or investor entrusts his entire life’s work to a single government-controlled financial regulatory environment.

Being at the mercy of one government’s whim can lead to significant economic loss and restrictions, and the only way to hedge against these issues is by breaking that monopoly.

For US citizens, this can be a difficult move. Due to the US government’s demand to be involved in US citizens’ banking business, many international banks simply refuse to work with US citizens.

However, a real-world legal workaround solves this problem in unparalleled ways.

It’s not that international banks won’t deal with US citizens, it’s that they won’t open accounts using US identities.

This is where investment migration, in the form of citizenship or residency by investment, comes into play. It is the apex strategy that sophisticated entrepreneurs and investors know how to leverage.

A second citizenship – or an alternative legal residency via a Golden Visa program – is an alternative legal identity. An identity that connects the entrepreneur or investor to another country instead of the United States.

International banks will open accounts under these alternative legal identities.

By legally diversifying their identity by establishing themselves as a citizen or resident of another country, entrepreneurs and investors can mitigate the risk of a singular government passing an ill-planned blanket law or restrictive codification that could ruin their livelihood.

Having a second citizenship or residency in another country is the ultimate hedge – it allows unfiltered access to banking and financial instruments, and entrepreneurs and investors can diversify their wealth management practices and avoid political bottlenecks.

This is the very embodiment of Flag Theory.

What is Flag Theory?

Flag Theory is a strategic—or old money—concept used primarily by HNWIs seeking to optimize their personal freedom, privacy, and wealth.

At its core, Flag Theory involves diversifying one’s lifestyle, assets, and personal affairs across multiple countries to reduce the reliance on any single government, market, currency, or economy.

This diversification aims to maximize personal freedom, capitalize on tax optimization, protect assets, and enhance privacy – while creating a mechanism of generational wealth.

The original theory, which has evolved over time, is based upon the practice that a sophisticated investor is not subject to a single ‘flag’ or country but owns their sovereignty by combining the benefits of having multiple ‘flags’:

Second Passport/Second Citizenship: In the 21st century, citizenships and passports are the real global currency – the more you have, the less dependence your life has on a single regime and its control over your life.

Alternative Residency: Establishing residency in an additional country with favorable tax laws [Non-Dom Tax Programs] or a more desirable lifestyle provides unparalleled security and, paired with the second passport, is the ultimate and best real-world Plan B money can buy.

Business Base: Incorporating and running businesses in jurisdictions that offer legal and financial advantages, such as lower corporate taxes or fewer regulations, keeps your businesses operating on your terms.

Asset Haven: Protecting wealth by placing assets in countries with strong asset protection laws and stable financial institutions keeps your property out of reach of others [including governments, even the US government].

Banking: Establishing banking relationships and accounts in stable and reputable jurisdictions outside of one’s home country utilizing one’s legal alternative identity is the best protection an entrepreneur or investor can have – Bank on your terms.

The banking flag also facilitates international business and investment by providing currency diversification, access to global financial markets, and efficient cross-border transactions.

Personal Playground: Choose locations

- To live

- Partially reside

- Spend significant time

This should be based on lifestyle preferences separate from one’s citizenship, business, or asset flags.

Flag Theory is a strategy that involves selecting countries with strong financial regulations, political stability, and robust banking secrecy laws, to safeguard assets against seizure, nationalization, or undue scrutiny.

While de-banking is a relevant and growing issue, the optimal strategy for all investment postures is diversification. However, for this strategy to genuinely work, it must be global.

By adopting Flag Theory, a HNW entrepreneur or investor can safeguard their personal safety and financial well-being.

Investment migration is Flag Theory in practice

Utilizing an offshore trust or bank account is an excellent way to ensure that one’s money isn’t vulnerable to a singular government’s decision-making – contemporaneously or with regime changes.

The Caribbean and Malta provide some of the best options and most effective Flag Theory solutions.

Malta is the only EU citizenship by investment program that checks all the Flag Theory boxes – such as allowing dual citizenship.

Maltese citizenship is EU citizenship and allows an entrepreneur or investor to open bank accounts in Switzerland, for example, using their Maltese/EU legal identity.

Likewise, Turkey offers an incredible real estate investment opportunity that is fused with a second citizenship and passport as well.

The Caribbean Five are the most popular citizenship programs in the world because they are currently the most affordable.

The Caribbean Five begin at only $100K.

Breaking News – on 23 March 2024, members of the Caribbean Five signed a collective agreement to increase the cost of their citizenship programs to at least $200,000 and such increase must be implemented “no later than 30 June 2024”

Let’s look at St. Kitts and Nevis as an example. Nevis is a historically trusted and secure offshore banking destination.

Trusts in St. Kitts & Nevis are not bound or subject to US court jurisdiction, allowing investors to utilize the banking services and maintain their funds in a secure environment.

When paired with citizenship—via the St. Kitts and Nevis citizenship program—entrepreneurs and investors can capitalize on the benefits of offshore banking while leveraging the power of citizenship protections.

This strategy alone can help protect wealth and assets from invasive US laws and banking regulations that can unjustly affect or seize them.

Offshore bank accounts in the Caribbean also provide robust banking services in multiple currencies, mitigating the risk of devaluation.

Leaving oneself at the mercy of US banks and calling it patriotic or convenient is not only the opposite of a solid investment strategy, but one may as well inform all relevant parties—such as divorce attorneys, insurance companies, etc—of one’s banking location and information.

Going global is the best way to hedge against political, legal, and economic risks, such as de-banking. This is why many HNWIs adopt Flag Theory’s practices.

Astons – Seasoned experts in self-sovereignty

De-banking is not the only threat or concern to US and UK HNW entrepreneurs and investors; it is simply one of the latest.

In fact, in the past weeks, the UK has terminated the Non-Dom Tax Program, which can also be added to the list.

Flag Theory was originally a concept of elitism and luxury, but in the 21st century, it is a requisite cornerstone of any effective investment and wealth strategy.

Multiple Caribbean countries, as well as Malta, Turkey, and Vanuatu, offer simplified citizenship by investment programs that do not require any physical residency.

Citizenship by investment programs are affordable, credible, and streamlined, making them an excellent first step for those seeking elevated individual sovereignty paired with the only real-world Plan B that will work when needed.

Countries in the EU, such as Portugal, Greece, Spain, and Cyprus, offer Golden Visas, otherwise known as residency by investment programs. These are outstanding options for investors looking to establish a foothold in Europe and leverage the powerful Non-Dom Tax programs.

The easiest way to make this power move toward possessing alternative legal identities and diversifying ‘the world of you‘ is to schedule a Free Confidential and Comprehensive Consultation with Astons today and speak with one of our investment migration experts.

Astons has been a global and industry leader in the investment migration industry and self-sovereignty strategy for over 30 years, and the experts that will comprise your dedicated Astons team are the players who have helped mold the industry into what it is today.